Estate planning is the process of anticipating and arranging for the management and disposal of a person’s assets during the person’s life in preparation for a person’s future incapacity or death. While on its face, this may come off as simple, many individuals struggle with estate planning for a variety of reasons. This is especially true for those who have accumulated substantial wealth, referred to in this book as Wealth Creators.

Chapter 1 Introduction to Cross-Border Estate Planning

Estate planning is the process of anticipating and arranging for the management and disposal of a person’s assets during the person’s life in preparation for a person’s future incapacity or death. While on its face, this may come off as simple, many individuals struggle with estate planning for a variety of reasons. This is especially true for those who have accumulated substantial wealth, referred to in this book as Wealth Creators.

For families based in multiple jurisdictions (commonly referred to as “Cross-Border Families”), estate planning may be even more arduous. This book aims to deliver workable solutions to Wealth Creators with family members and assets spread throughout several countries.

For non-U.S. persons with assets in the U.S. or descendants in the U.S. with U.S. citizenship or a U.S. green card, both the perceived cost of estate planning and the out-of-pocket legal fees and accounting expenses can be quite considerable. Moreover, depending on the Wealth Creator’s circumstances, the estate planning process can be unpredictable and may change over time. While each Wealth Creator’s approach to estate planning can and should be customized, we believe that knowledge of common structures used by others can serve as an important reference point.

The most common theme is that Wealth Creators who generated substantial holdings in Asia have:

When completing such a change in identity (becoming a U.S. person) or transfer in assets (moving assets into the U.S.), Wealth Creators may not fully understand the legal and tax implications. To this end, Asian Wealth Creators often attempt to resolve these issues by hiring professionals both in the U.S. and in Greater China.

Some even retain the services of the Big Four Accounting Firms or large and established global law firms. In our experience, engagements with these advisors rarely yield effective and cost-efficient results. In practice, many of these firms often have a difficult time piecing together the relevant laws and regulations of multiple jurisdictions.

Further complicating the situation, practitioners at U.S.-based law firms and accounting firms focus exclusively on the area of estate planning that they specialize in, often deferring to other qualified professionals’ opinions when questions relating to other areas of estate planning arise. Unfortunately, this often results in the client receiving subpar outcomes, conflicting opinions and hefty fees. This is where this book could be useful. Every example illustrated this book has been understood and utilized by Wealth Creators who have similar questions and concerns.

The lead author of this book has settled numerous trusts for himself and his family. The majority of structures in this book have not only been created by the author, but they are also currently being updated, maintained, and improved upon to this day. Unlike most practitioners, who attest to their clients’ successes, the author actually utilizes this book’s very structures and can speak to their efficacy.

Wealth Creators should consider their succession strategy a core task and prioritize the creation of a sustainable plan to pass their assets on to their successors. While understanding key concepts can help, case studies are often the best way to truly understand estate planning and wealth succession. We include five illustrative case studies herein to help Wealth Creators with thinking about their trust planning.

Background:

Mr. Fang is the Founder of a large restaurant group in Shanghai (a listed company) and just turned 65. Since Mr. Fang had a modest upbringing, he has always been extremely cautious financially. He primarily invests cash generated from his operating businesses in low-risk financial investments and real estate in China. Mr. Fang’s wife and children have lived in Los Angeles, CA for many years now, where he purchased a house under his wife’s name in 2015. Throughout the years, he has also gifted his wife various sums, which she has since invested in an LLC that holds equity investments in U.S. office buildings and shopping malls. While Mr. Fang’s wife and children have received U.S. green cards, Mr. Fang has not applied for immigration and is a non-U.S. person (a non-resident alien for U.S. tax purposes).

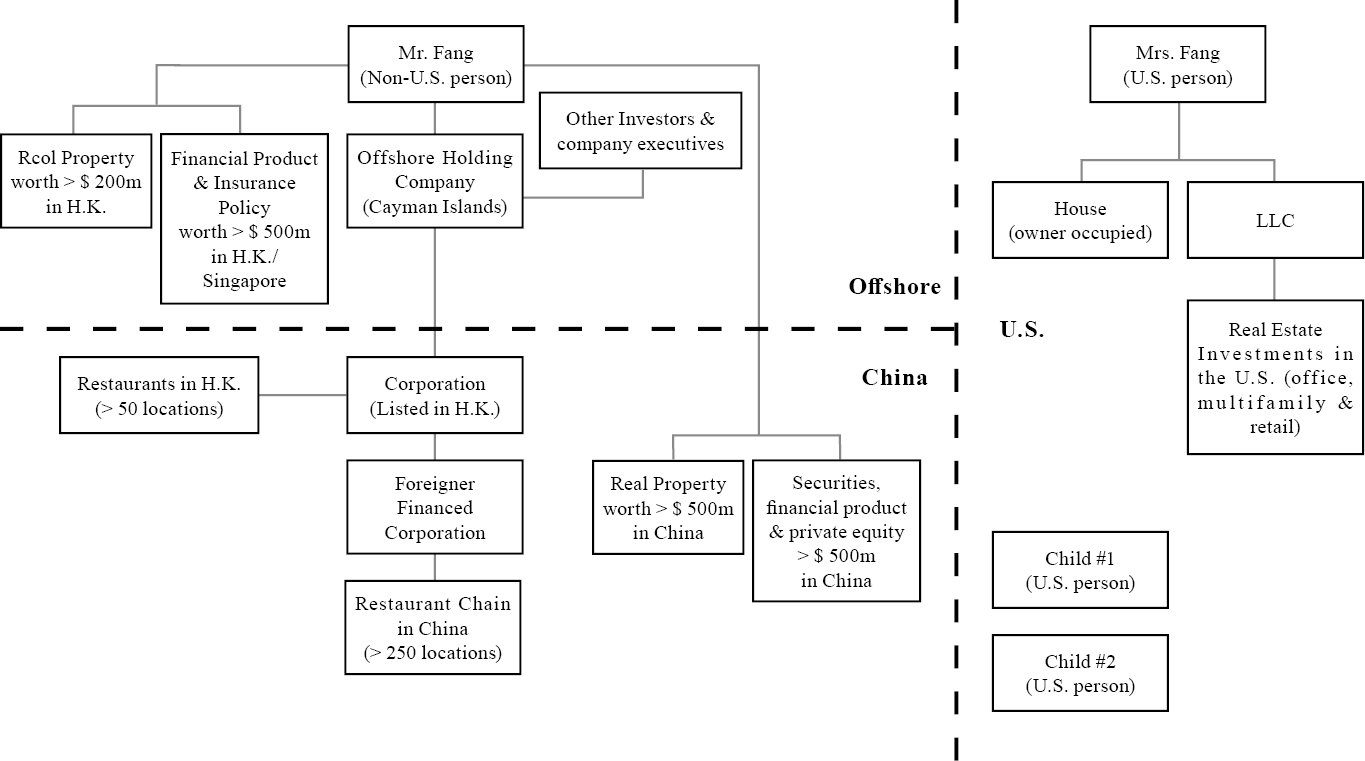

Below is a chart of Mr. Fang’s assets prior to estate planning:

Key Planning Points:

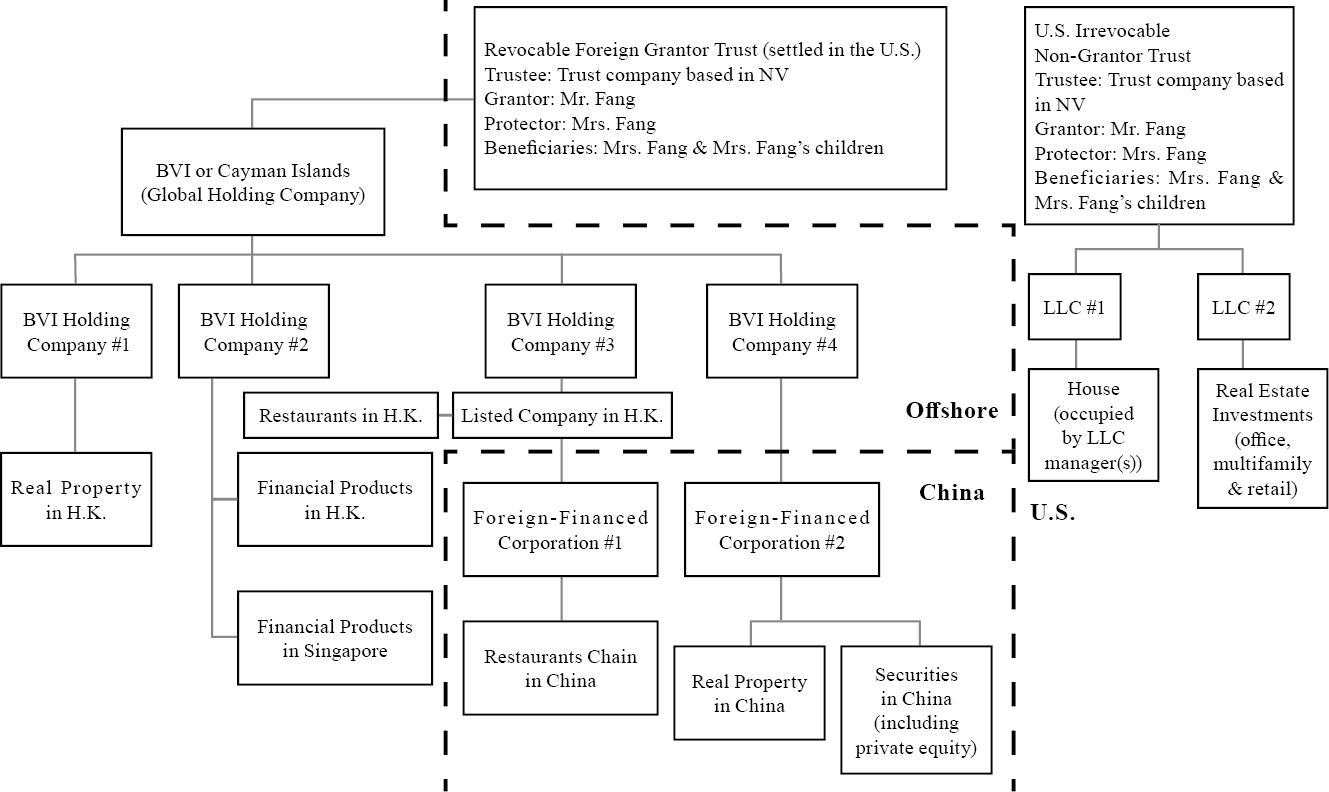

Below is a chart of Mr. Fang’s assets after estate planning:

Background:

Mr. Huang, an entrepreneur based in China, owns several factories in Nanjing, Suzhou and Chengdu. His operations in China are held by W Corp., a Chinese holding company. W Corp. is owned by X Corp., a Hong Kong holding company that he holds. Over the years, he has transferred much of the profits from Chengdu to a Hong Kong bank account held by Y Corp., another wholly owned company. Periodically, he transfers funds from his Y Corp. bank account to another Hong Kong bank account held by Z Corp., a British Virgin Islands (BVI) company. Funds accumulated in Z Corp. are invested in various financial products and investments in both Hong Kong and Singapore.

While Mr. Huang is a Chinese citizen and does not have any plans of relocating to the U.S., his wife, daughter and sons are all based in the U.S. and have U.S. citizenship. Over the years, Mr. Huang has come to realize the need to formulate a plan that would allow him to effectively transition his assets to his descendants; however, he is unsure of how to proceed given the complexity of his structures.

Specifically, he had the following questions:

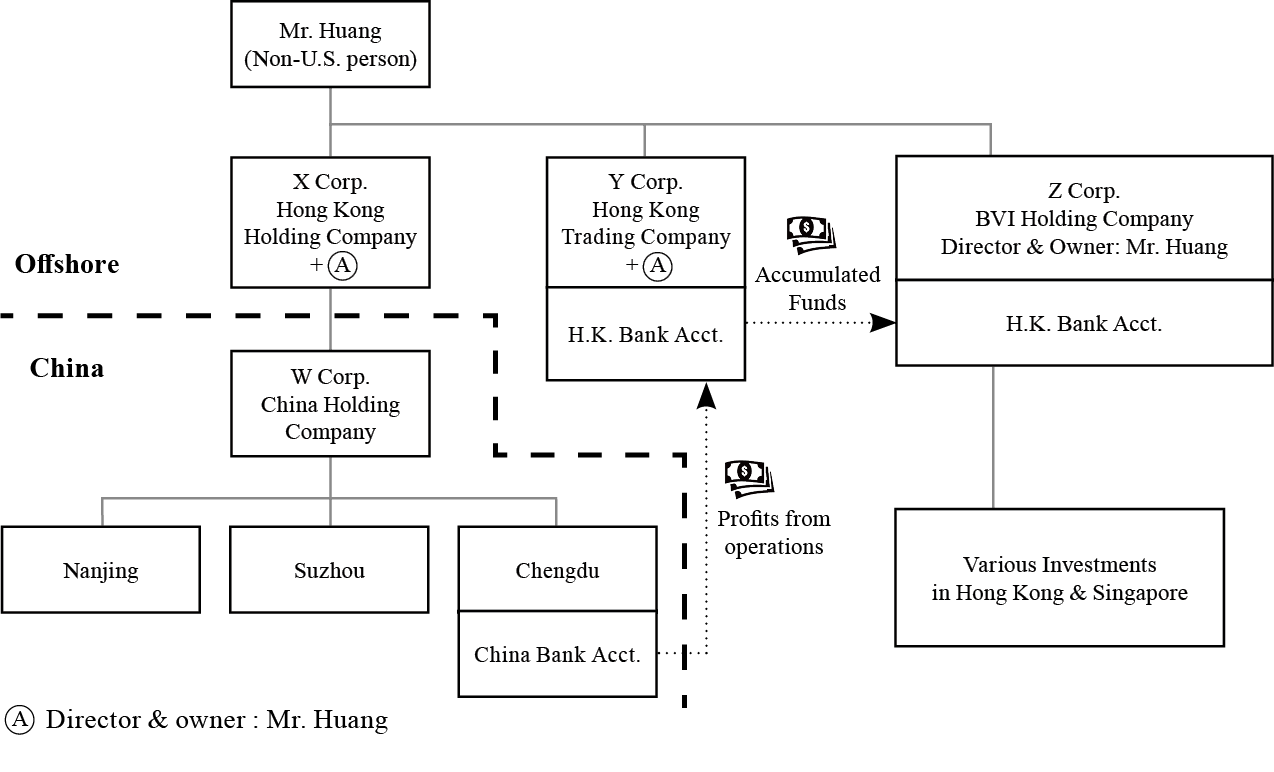

Below is a chart of Mr. Huang’s assets prior to estate planning:

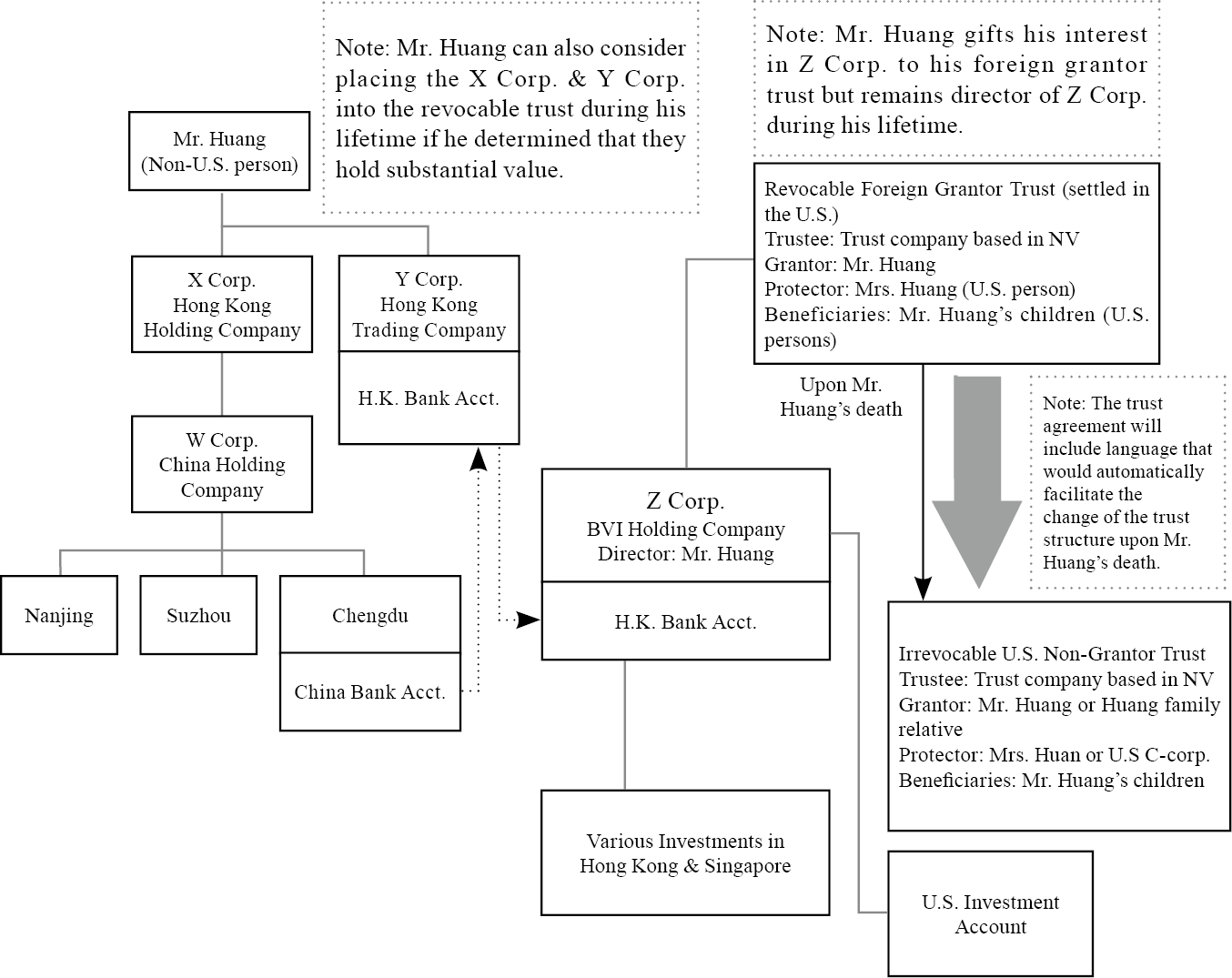

Below is a chart of Mr. Huang’s assets after estate planning:

Analysis:

Background:

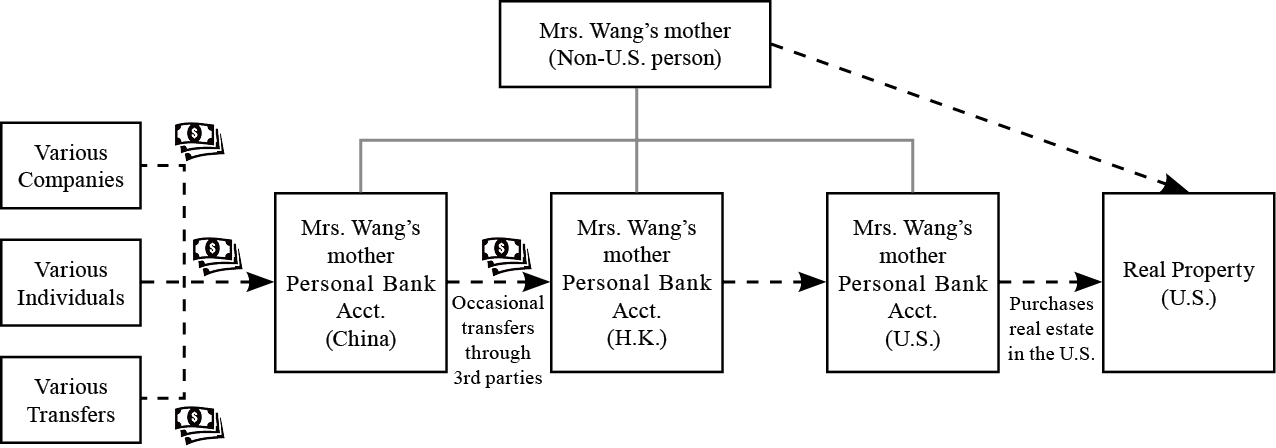

Mrs. Wang is a longstanding executive at a Shanghai-based construction company. Over the years, she has accumulated substantial wealth in China and overseas. Last year, she attained a Green Card through investment in the EB-5 program and moved to the United States with her children. Like many Wealth Creators, Mrs. Wang wished for her descendants to move to the U.S. and settle there permanently. Over the years, she has learned that the U.S. levies hefty taxes on the wealthy. Prior to her becoming a U.S. person (attaining a U.S. green card), she transferred funds to her mother, a Chinese citizen. She then purchased many U.S. properties in the U.S. under her mother’s name.

Two years later, a close friend introduced her to a U.S. accountant, who informed her that U.S. estate taxes are levied not only on U.S. persons, but also foreigners with certain assets in the U.S. Furthermore, the gift and estate tax exemption for foreigners was a mere $60,000 and that any taxable estate in excess of the exemption would generally be subject to a 40% estate tax. Hearing this, Mrs. Wang was in disbelief. She now began searching for a way to decrease her U.S. tax exposure.

Mrs. Wang’s Structure (Prior to Restructuring)

Reflections on Succession:

Succession Framework Analysis:

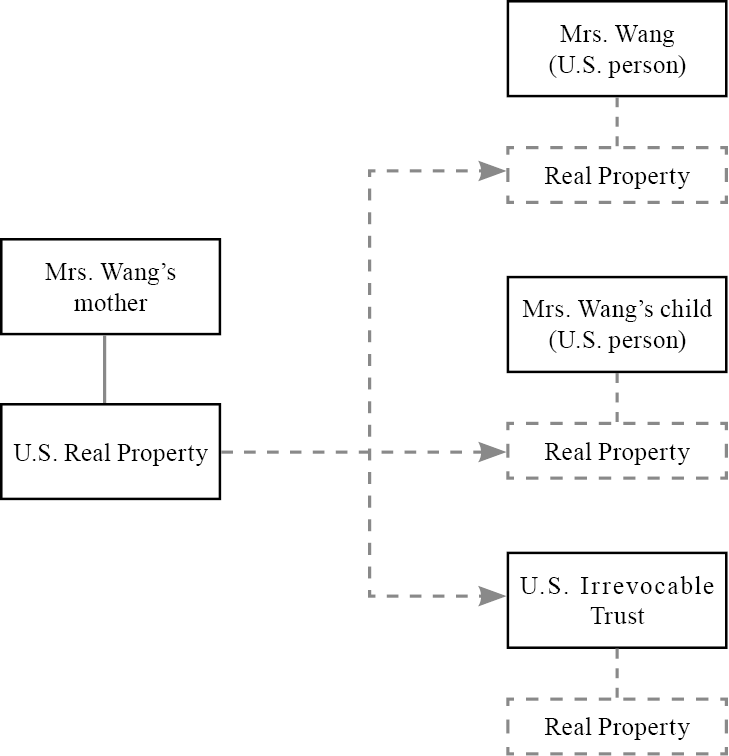

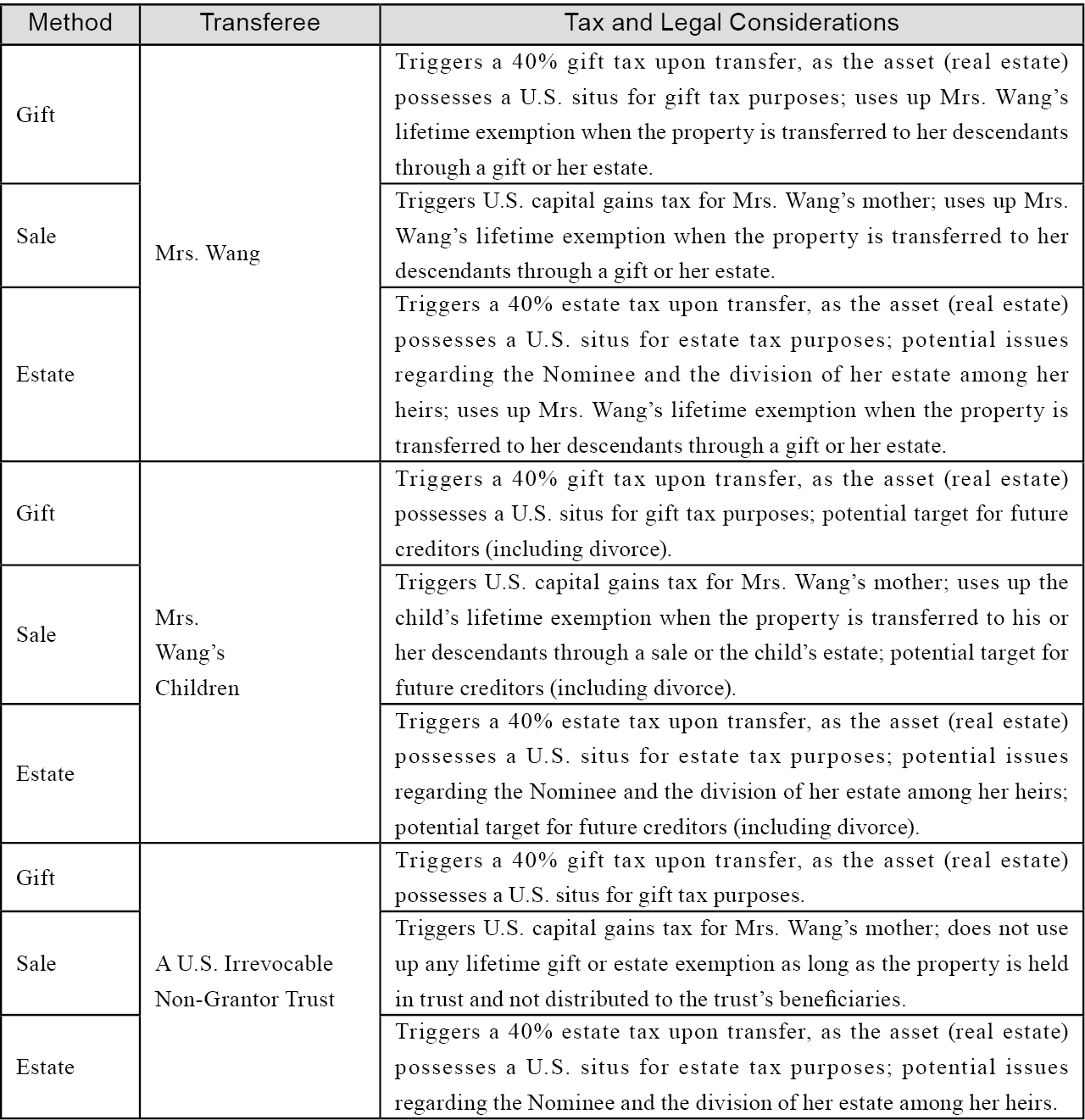

In order to transfer the property from Mrs. Wang’s mother to Mrs. Wang, her children or a U.S. trust, there may be a substantial tax consideration. Furthermore, assets held under individuals may be subject to further U.S. gift and estate taxation and can be a potential target for creditors if any legal disputes arise. Lastly, the Nominee may have other heirs, who may or may not know that the asset does not belong to the Nominee. Potential transfers and their tax and legal effects are summarized below:

Note 1: Taxes are generally taxed at market value and not cost basis, based on the timing of the gift or estate. Typically, valuations of real estate are conducted by licensed real estate appraisers based in the property’s jurisdiction.

Note 2: Lifetime exemption mentioned above refers to the unified lifetime gift and estate tax exemption available to U.S. persons.

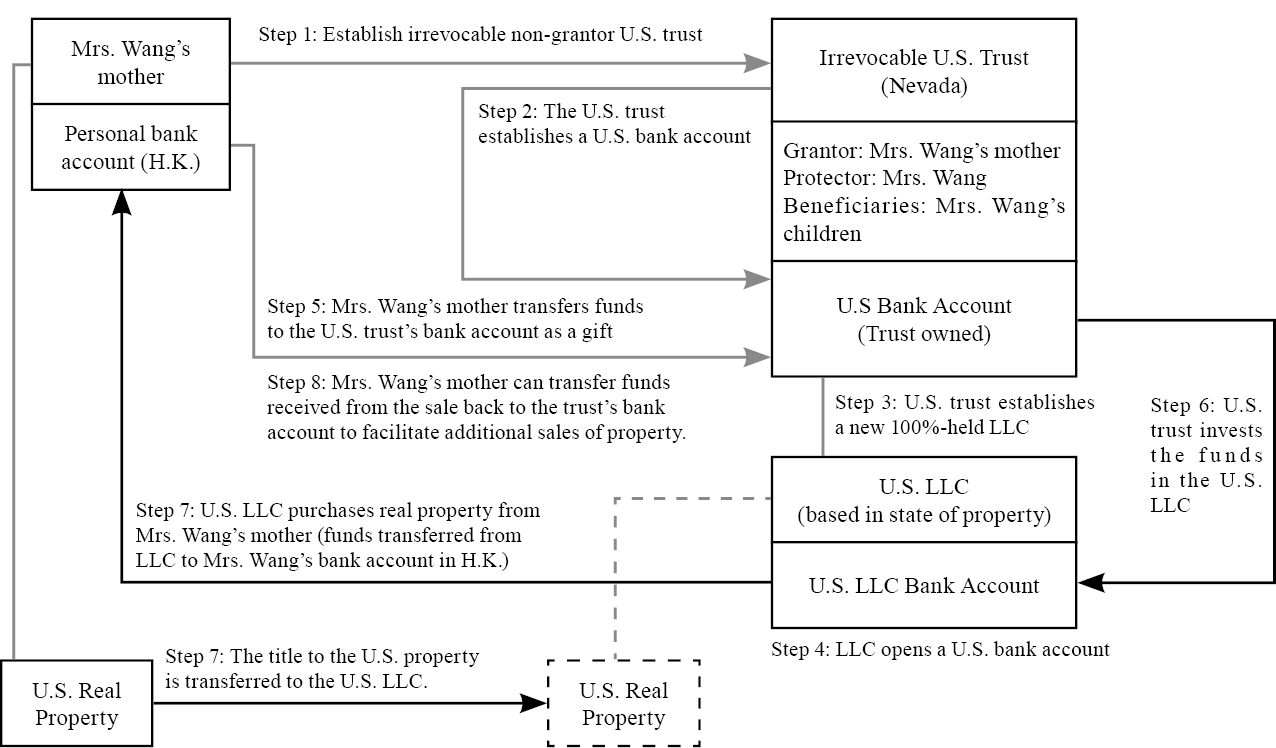

Mrs. Wang’s Structure (After Restructuring)

If Mrs. Wang’s mother gifts the real estate to either Mrs. Wang or a U.S. Irrevocable Trust, the gift is taxed at 40% of the property’s market value. If Mrs. Wang chooses to leave the existing structure as is, her mother’s heir would be subject to a 40% estate tax upon her mother’s death. To eliminate U.S. transfer taxes, Mrs. Wang should seek to unwind the previous transaction.

Background:

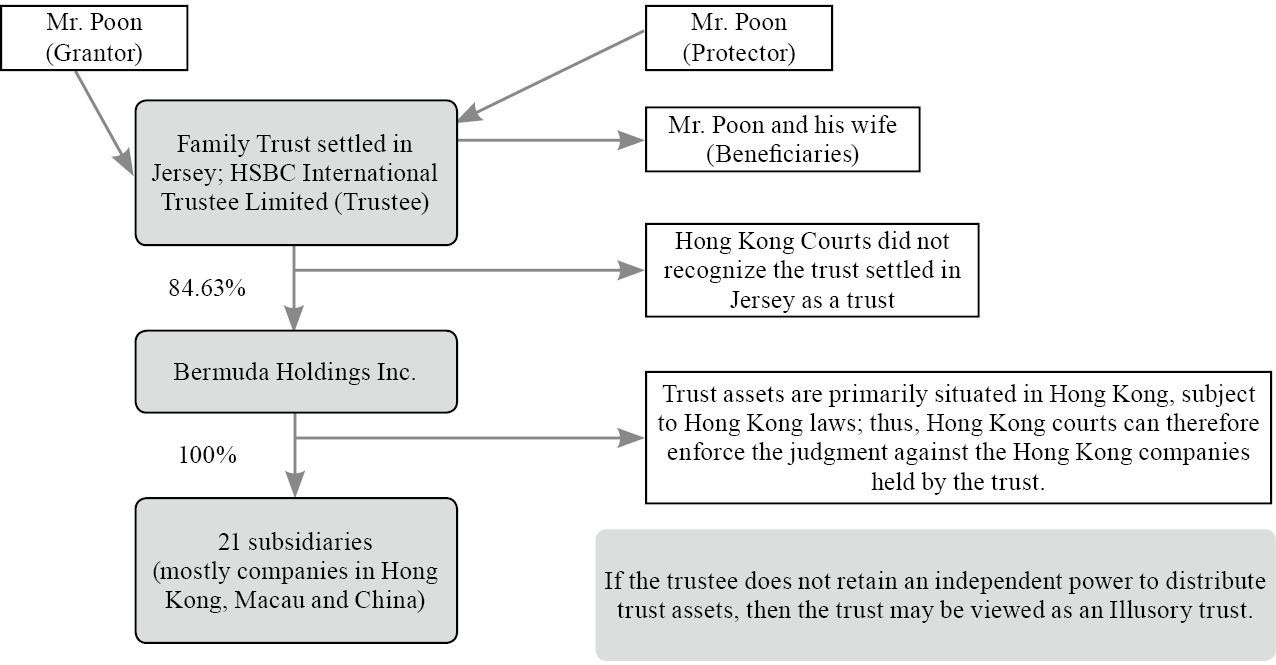

In the past decades, Wealth Creators often used offshore trusts settled in various jurisdictions to protect their assets. Otto Poon, the founder of Analogue Holdings, settled an irrevocable discretionary Jersey Trust in July 1995. He served as the Trust’s Grantor, the Trust Protector, and one of the Trust’s Beneficiaries. HSBC’s Trust Company was appointed as trustee of his trust. After the Trust was established, he gifted 85% of his holdings in Analogue to his trust.

Since Mr. Poon still retained effective control over to the trust assets, the Hong Kong Court of Final Appeal held that the trust assets were includible in his matrimonial assets. The trust thus did not serve its intended purpose.

Reflections on Succession:

At the time of the ruling, the court decision shocked many Wealth Creators, who previously believed that their assets would be thoroughly protected by offshore trusts no matter whether they held substantial control over the trust’s assets or not.

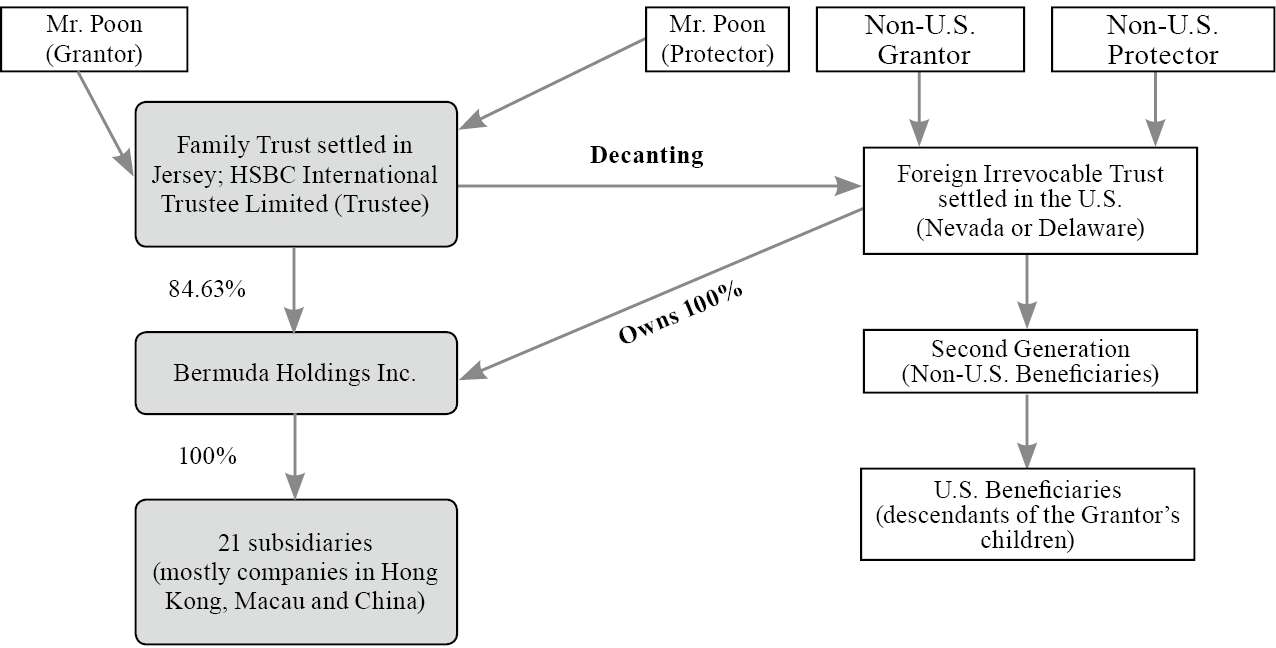

In Structure (2), since the primary purpose of such trusts is to protect the trust’s assets and to pass these assets on to the trust’s beneficiaries, powers are more often clearly delineated, with the grantor retaining minimal to no powers. We advise that families seeking to create these structures find competent legal counsel in all applicable jurisdictions in order to ensure that the assets held in these trusts would be protected and that the trust would be treated as an entity independent from the trust’s grantor, protector, and beneficiaries.

Succession Framework Proposal:

The Offshore Trust (Prior to Restructuring)

Suggested Structure

Succession Framework Analysis:

While offshore trusts have long been a mainstay for wealthy families, balancing the need for control with the asset protection qualities of a trust is important to keep in mind. If the trust’s grantor retains many powers over the trust, courts may view the trust skeptically or, in a worst-case scenario, deny that the trust ever existed. This could potentially cause assets to be seized by creditors. The following steps are crucial for determining whether a trust is able to serve its function and protect assets from potential creditors:

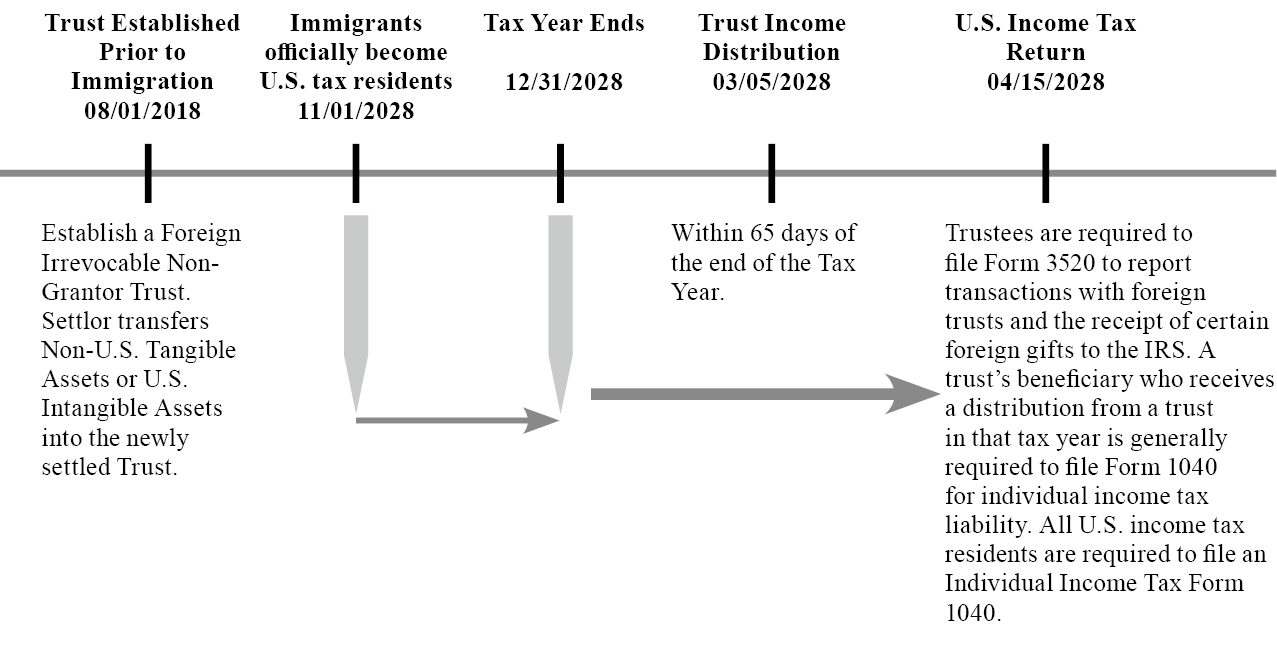

Background:

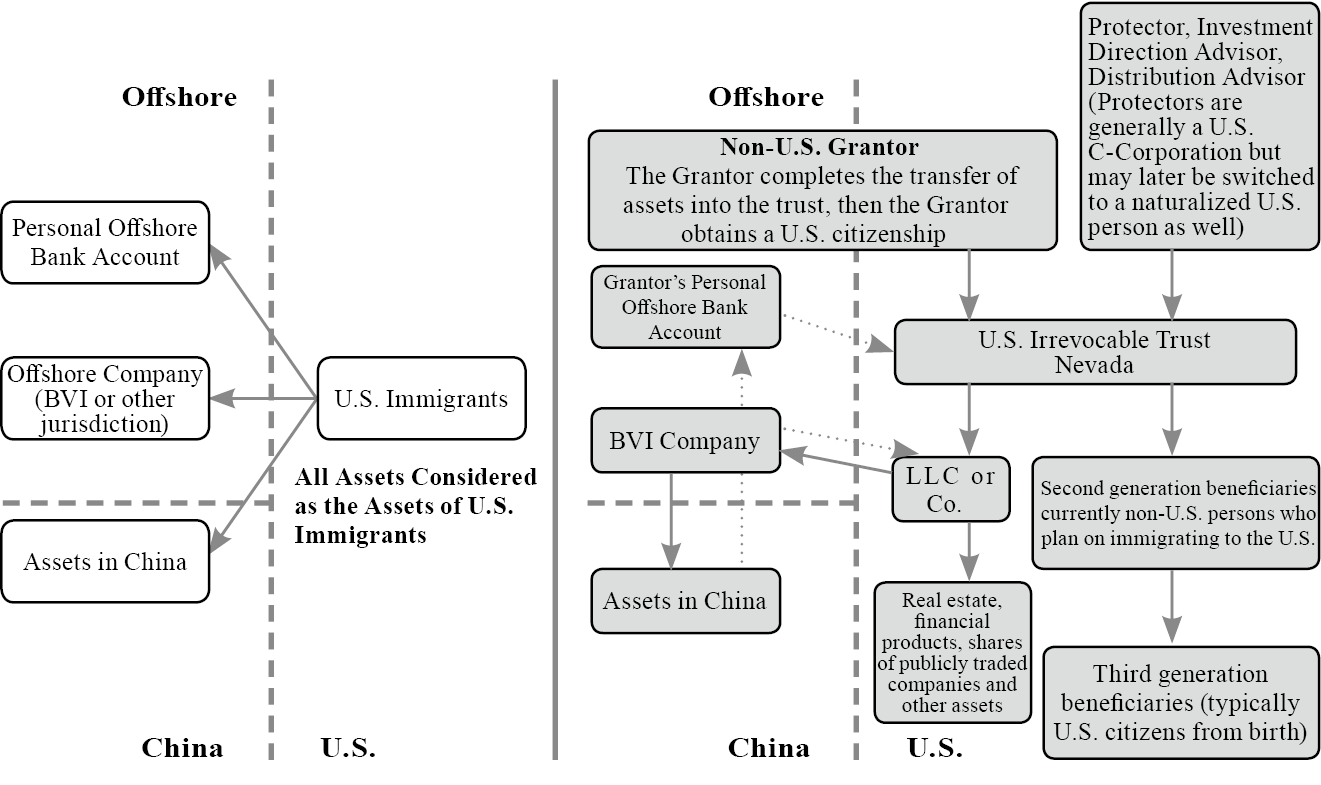

Mr. Jiang and Mrs. Jiang, a married couple residing in China, finally received notices that they were granted their U.S. Permanent Resident Cards (Green Cards) after more than a decade. As they were not sure that they were going to ever receive their green cards, they never considered the tax consequences of their U.S. residency status. When they came to the U.S., they consulted with trusted U.S. CPAs, who informed them that their worldwide assets would now be subjected to U.S. income, gift, and estate taxes, much to their disbelief.

Reflections on Succession:

1. Over the past couple of years, Hong Kong, Australia, and Canada have increasingly tightened their immigration policies. The enactment of EB-5 in the U.S. came as a relief to many Chinese families seeking to permanently relocate their families. Tax advisors often advised Wealth Creators to retain their original citizenships and tax residency, while their spouses applied for Green Cards, since the U.S. generally taxes its residents more heavily. However, since many Chinese nationals believe that a married couple should stay together indefinitely and never separate, we frequently see both the Wealth Creator and their spouses attain Green Cards.

2. Once a foreign national obtains a Green Card and becomes a U.S. tax resident, he or she is liable for not only U.S. income taxes on his or her worldwide income, but also subject to disclosure requirements of his or her offshore assets in accordance with numerous U.S. laws and regulations. Many wonder whether there is a way to attain U.S. permanent residency, without the enormous tax and disclosure responsibilities that come with it. For those that created their wealth outside of the U.S., is there a path to U.S. citizenship without payment of considerable income, estate and gift taxes?

Succession Framework Proposal

Succession Framework Analysis:

2. Families immigrating to the U.S. often wish to transfer part or all of their wealth from foreign jurisdictions into the U.S. We generally recommend families bringing in excess of $2 million seek guidance from licensed professionals to increase their understanding of the U.S. tax and legal systems.

3. For U.S.-bound individuals with significant wealth, settling a U.S. non-grantor trust may help with both minimizing applicable taxes and asset protection. Individuals with assets in excess of the lifetime U.S. gift and estate tax exemption may be subject to a 40% estate tax for assets above that threshold. The tax is levied on both assets attained before and after an individual immigrates to the U.S. Additionally, individuals who wish to make gifts or leave assets in excess of their lifetime exemption to those 37.5 years younger may face an additional transfer tax, the U.S. Generation-Skipping Tax (GST).

4. When settling certain U.S. trusts, both individuals and corporations may be named as fiduciaries. U.S. trusts are typically established and funded by its grantor with governance allocated among the trust’s fiduciaries (typically, the Trust Protector, the Distribution Advisor, and the Investment Direction Advisor, among others).

In Directed Trusts, the Trustee generally handles the administrative and secretarial functions of the trust. It is generally advisable for Wealth Creators to seek out the services of a licensed Trust Company to act as the Trustee. Doing so ensures that there is ongoing oversight of the trust and that the various secretarial functions are being monitored. Trust companies serving as Trustee of directed trusts typically charge a flat annual fee rather than a percentage of assets under administration.

5. While gifts from non-U.S. persons are often tax-free, Wealth Creators who are considering gifts above $2 million (USD) should consider making the gift to a trust for the intended Beneficiary, rather than making a gift directly to the Beneficiary. Since the recipient of the gift is the trust itself rather than an individual, the trustee of the trust would file Form 3520 to report the gift. As a trust receiving large sums is more common, it is less likely to be scrutinized than if an individual were to receive the large gift.

6. U.S. persons receiving distributions from or controlling foreign trusts often face unfavorable or even punitive U.S. income tax consequences. As such, Wealth Creators seeking to immigrate the U.S. should consider unwinding their non-U.S. trusts in favor of U.S. trusts. Even Wealth Creators who are not personally seeking to immigrate to the U.S. but have U.S. descendants should consider shifting their assets into U.S. trusts, as they are generally more protective of U.S. descendants both from an asset protection perspective and from a U.S. tax perspective. When structured properly, moving assets into a U.S. trust can lead to (1) a clearer wealth transfer structure, (2) preferable tax treatment, (3) stronger asset protection and (4) lower ongoing maintenance costs (relating to both Trustee fees and accounting and disclosure requirements).